Does Bankruptcy Help with Medical Debt?

Medical debt is one of the leading causes for bankruptcy right after loss of income. It is a debt that all too often accumulates due to a major emergency injury or a unexpected catastrophic illness. With the rising costs of medical care, inadequate health insurance, and insufficient personal income, it is no shock that individuals […]

Debt Collectors Illegal Tactics

Debt collectors have long been known for their aggressive tactics when it comes to collecting payments from debtors. In recent years, debt collectors have been accused of using illegal methods to collect money from those in debt. These tactics can range from making threats of legal action to using false or misleading information. Unfortunately, these […]

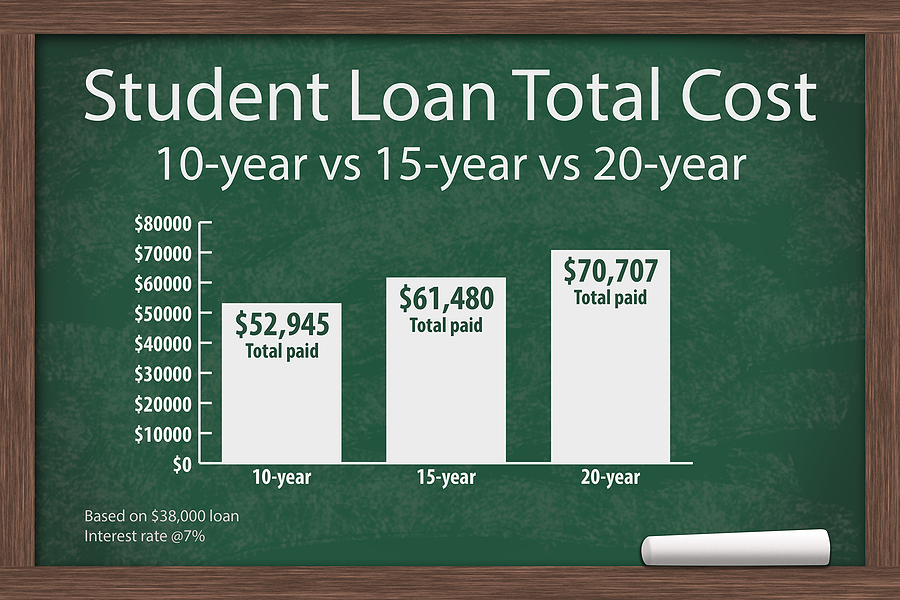

Student Loan Debt and Bankruptcy

Getting rid of student loan debt is an issue that affects thousands of Americans. Bankruptcy is often a top choice for a fresh financial start, but borrowers are not automatically entitled to a discharge of their student loans. Depending on your situation, you may need to file a forbearance request or negotiate a more reasonable […]

Will Bankruptcy Affect Taxes?

One common question people have during the bankruptcy process is if bankruptcy affects taxes. They wonder how filing for bankruptcy protection will impact their tax burden. While every person’s tax situation is different, there are some commonalities worth noting about taxes and bankruptcy. Here are some things that you should know: Bankruptcy and Back Taxes […]

What Does a Bankruptcy Trustee Do?

A Bankruptcy trustee plays an important role in the process of filing for bankruptcy. They are a crucial part of the process and can help ensure that it runs as smoothly as possible. In this article, learn what bankruptcy trustee does and the responsibilities they have. What is a Bankruptcy Trustee? A bankruptcy trustee is […]

Can Student Loan Debt Be Discharged with Bankruptcy?

If you’re having trouble making ends meet in part because of your student loans, you might wonder if there is any way to get out from under that financial burden. Fortunately, there are a few options available to help ease the strain—especially if you’re facing an imminent drop in income or standard of living due […]

Things To Do to Recover from Bankruptcy

Bankruptcy can be a useful tool for dealing with overwhelming debt and relieving pressure, but it’s not something that anyone wants to enter into lightly. Once you have filed, fortunately, there are things you can do to recover from bankruptcy faster. Undergoing bankruptcy doesn’t have to be difficult. But you will have to get over […]

Will I Lose My Car in a Bankruptcy?

Bankruptcy can be a complicated process, and there are many different kinds of bankruptcy. Each type of bankruptcy will have different effects on your financial situation and how you move forward with your life. For some people, filing for bankruptcy might be the best way to get back on track financially and get a fresh […]

What is an Individual Bankruptcy Attorney?

In the event that you are drowning in debt and unable to see an end in sight, filing for bankruptcy may be your best option for getting a fresh financial start. If you’re thinking about going this route, you might be wondering what kind of bankruptcy attorney is best for you. If you’re considering filing […]

Avoiding Foreclosure by Filing for Bankruptcy

If you own a home and find yourself unable to make your mortgage payments, you might be afraid that you’ll lose your house to the foreclosure process. Avoiding foreclosure though can be done by filing for bankruptcy. Let’s look at how bankruptcy may be an option. Many people who are struggling financially mistakenly believe that […]